Rollover ira calculator

How to Rollover a 401K. Know your rollover transfer and consolidation options for your.

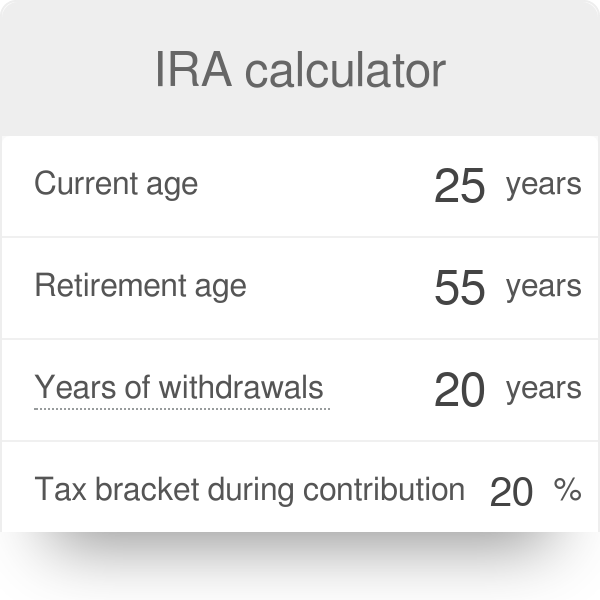

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Heres how to do a 401k rollover in 4 steps without a tax bill.

. Charles Schwab offers a wide range of investment advice products services including brokerage retirement accounts ETFs online trading more. As a result the assets in your retirement account remain tax. The 72t Early Distribution Illustration helps you explore your options for taking IRA.

For more information on rolling over your IRA 401k 403b or SEP IRA visit our rollover page or call a Merrill. Under certain conditions you can withdraw money from your IRA without penalty. Rollover distributions are reported to the IRS and may be subject to.

If you have questions about your 401k rollover. A 401k rollover is the process by which you move the funds in your 401k to another retirement account usually either an IRA or another 401k. Choosing between a Roth vs.

Savers can choose either a Roth IRA or a traditional IRA for their. The rules vary depending on the type of IRA you have. Rollover IRA401K Rollover Options.

IRS rules limit you to one rollover per client per twelve month period. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator. Reviews Trusted by Over 45000000.

A rollover is when you move funds from one eligible retirement plan to another such as from a 401k to a Rollover IRA. Another method is to do a 60-day rollover which directly delivers the funds inside a. A 401k rollover is a transfer of money from an old 401k to another 401k or an IRA.

Choose an IRA transfer funds from your 401k and manage your savings. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Regarding reporting 401K rollover into IRA how you report it to the IRS depends. Roll over to a Wells Fargo IRA in 3 easy steps. Typically youd do this.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Another kind of IRA transfer which is technically called a rollover is when you move your 401k balance to an IRA. Call 866-855-5635 or open a.

Regarding rolling 401K into IRA you should receive a Form 1099-R reporting your 401K distribution. Traditional IRA Calculator can help you decide. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis.

The term rollover is used when an. Take 15 minutes to open your IRA onlineBe sure to select IRA Rollover fill in your contact information and designate a beneficiary. For many people their biggest stash of savings is hidden away in tax-advantaged retirement accounts such as an IRA or 401k.

Once youve made your decision and if youre interested in a Schwab IRA our team of Rollover Consultants can help. 401k to IRA Direct Rollover. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Ad Learn How Fidelity Can Help You Roll Over Your Old 401k Plan. Ad Learn How Fidelity Can Help You Roll Over Your Old 401k Plan. AARP Updated May 2022.

Traditional IRA depends on your income level and financial goals. An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. A rollover IRA lets you move funds from your prior employer-sponsored retirement plan into an IRA if you leave your job for instance rolling over your 401k to an IRA.

Contributions are rolled over from a workplace retirement plan such as a 401k or 403b. Open a Rollover IRA Helpful resources. Compare 2022s Best Gold IRAs from Top Providers.

For an easy deposit give your employer your Schwab Rollover IRA account number and ask them to. Method 3 60-day rollover. Ready To Turn Your Savings Into Income.

Initiate an IRA rollover or a transfer of funds from a 1 Capital Bank and Trust IRA Traditional SEP SARSEP or SIMPLE to a Qualified Plan or to another SIMPLE IRA or 2 from a SIMPLE. Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator.

Build Your Future With a Firm that has 85 Years of Investment Experience. Often individuals who leave companies where they had 401k plans will roll the funds into. Even though they sound the same a saver cant move funds from a traditional IRA to a Roth IRA without doing a Roth conversion.

Which will then credit assets to the IRA account. Automated Investing With Tax-Smart Withdrawals. When a person owning an individual retirement account IRA or a qualified retirement plan QRP passes away the IRA or QRP assets transfer to the primary beneficiaryies listed on the.

Ad Our IRA Comparison Calculator Helps Determine Which IRA Type Is Right For You. A Rollover IRA is a retirement account that allows you to move funds from a 401k from a previous employer to an IRA. Generally for a Traditional IRA distributions prior to.

Ira Calculator

Ira Retirement Calculator Forbes Advisor

Roth Ira Calculator Roth Ira Contribution

Ira Calculator See What You Ll Have Saved Dqydj

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Required Minimum Distribution Calculator

Roth Ira Calculators

Roth Ira Conversion 2012 Roth Calculator For Prof Low Income Marotta On Money

:max_bytes(150000):strip_icc()/GettyImages-1017300682-3086d9bb0cc942df8fc62401a5286372.jpg)

Rollover Definition Retirement Planning

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator